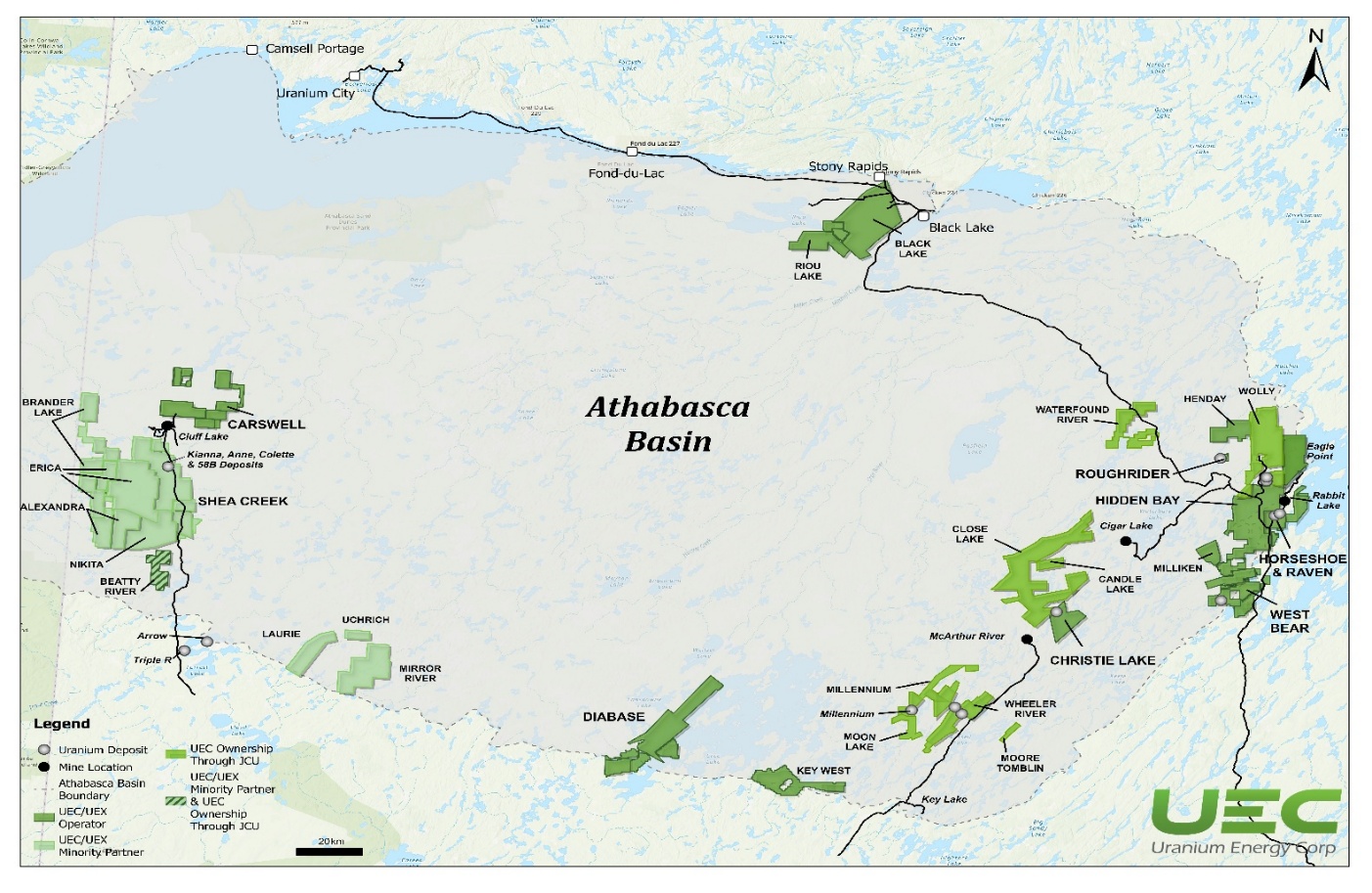

Canadian Projects Overview

Canadian Projects Overview

High-grade Uranium Assets in the Athabasca Basin

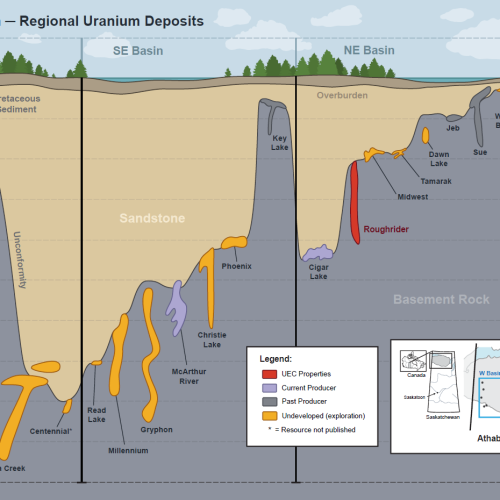

UEC is a leading uranium resource holder in Canada’s Athabasca Basin, one of the world’s premier uranium districts. Through strategic acquisitions, including UEX Corp. and the Roughrider Project from Rio Tinto, UEC has established a dominant position in the region. UEC’s Canadian assets provide the scale, quality, and strategic partnerships to support its long-term vision as a leading supplier of North American uranium.

Key Highlights:

- Significant Resource Base: 109.9 million lbs U₃O₈ (Measured & Indicated) and 68.4 million lbs U₃O₈ (Inferred) across 1.14 million acres.

- Premier Canadian Portfolio: 29 projects across the Athabasca and Thelon Basins, including six advanced-stage assets:

- Roughrider, Christie Lake, Shea Creek, and Horseshoe-Raven have outlined resources and are undertaking resource expansion.

- Kiggavik and Millennium are development-stage joint ventures with industry leaders Cameco and Orano.

- World-Class Asset – Roughrider: The 100% owned Roughrider project forms the cornerstone of UEC’s Canadian portfolio, supporting long-term growth and production planning.

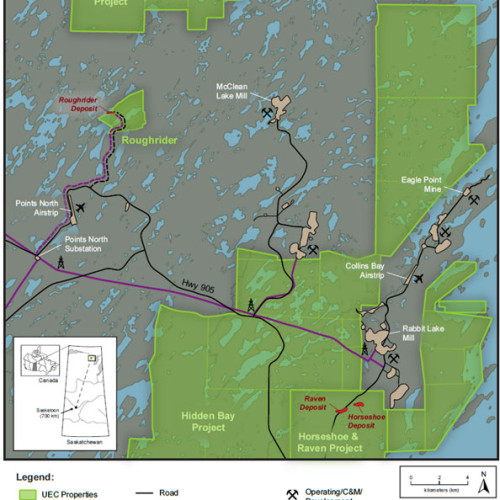

- Strong Infrastructure: Located within 100 km of 20+ uranium deposits, five producing or past-producing mines, and two uranium mills. The area features all-weather roads, an airstrip, and hydro-powered grid access.

- Path to Production: A decade of prior development and technical studies provides a strong foundation for future project advancement.

- ESG Commitment: Building on Rio Tinto’s baseline, UEC is committed to high standards in environmental stewardship, safety, and stakeholder engagement.

Roughrider Project Overview

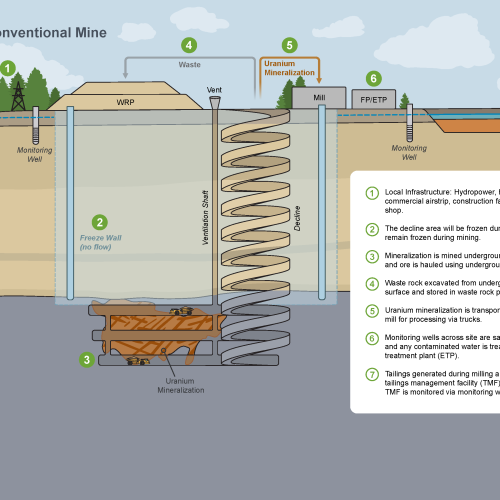

The Roughrider Project is a high-grade, exploration-stage uranium project in Saskatchewan’s eastern Athabasca Basin. Located 13 km from Orano’s McClean Lake Mill, the project spans 598 hectares and is near UEC’s other regional assets. The Roughrider Project is 100%-owned by a wholly-owned subsidiary of UEC. The project benefits from low capex, high-grade ore, and proximity to infrastructure—power, roads, airstrip, and a renewable hydroelectric grid. Over 20 uranium deposits, four mines, and two mills are within 100 km, further enhancing development potential.

Initial Economic Assessment Highlights:

- LOM Feed Grade: 2.36% U₃O₈

- LOM Production: 61.2 million lbs U₃O₈ over 9 years (~6.8M lbs/year)

- Initial Capex: US$545M (mill + underground mine)

- All-In Sustaining Cost (“AISC”): US$20.48/lb U₃O₈

- Post-tax NPV8%: $946M

- IRR: 40%

- Payback: 1.4 years (at $85/lb U₃O₈)

The 2024 technical report summary outlines 27.8 million lbs U₃O₈ in 389,000 tonnes grading 3.25% U₃O₈ in the Indicated category and 36.0 million lbs. U₃O₈ in 359,000 tonnes grading 4.55% U₃O₈ in the Inferred category.

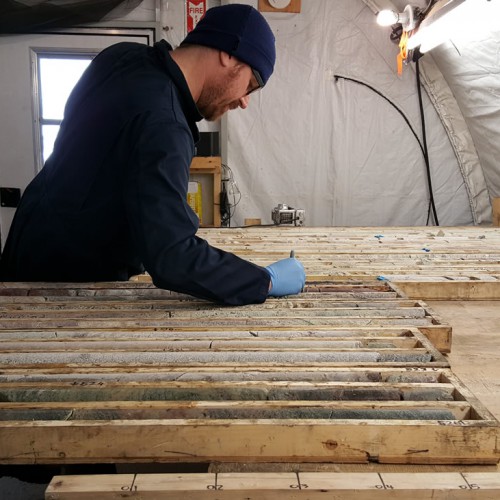

Originally owned by Hathor Exploration and later acquired by Rio Tinto for US$550M, UEC purchased the project from Rio Tinto on October 17, 2022, for US$150M in cash and shares. Discovered in 2008, Roughrider saw over 143,000 m of drilling. Rio Tinto advanced the project with environmental and pre-development work, including a partially reviewed Advanced Exploration Program.

Roughrider is comprised of three main zones:

- Roughrider West (RRW) – Discovered in 2008 with drill results showing 5.29% U₃O₈ over 11.9 meters.

- Roughrider East (RRE) – Discovered in 2009, highlighted by an exceptional intersection of 7.75% U₃O₈ over 63.5 meters.

- Roughrider Far East (RRFE) – Identified in 2011, returning 3.26% U₃O₈ over 42.8 meters.

The deposit is hosted at the unconformity between Proterozoic Athabasca sandstones and the older basement rocks of the Wollaston Group, approximately 240 meters below surface. Uranium mineralization at Roughrider is mono-metallic, occurring in stacked, parallel lenses within the basement rocks. These lenses are separated by intervals of barren or weakly mineralized rock (less than 0.5% U₃O₈) and plunge moderately to the northeast. The mineralization varies significantly in thickness and form, with high-grade zones composed of medium- to coarse-grained, semi-massive to massive pitchblende.

This unique geology and impressive grades make Roughrider one of the standout undeveloped uranium projects in the Athabasca uranium district.

Unless otherwise indicated, the scientific and technical information herein regarding the Roughrider Project has been derived from the S-K 1300 Technical Report Summary dated November 8, 2024, a copy of which is available under UEC's profile at www.sec.gov.

Christie Lake Project

The Christie Lake Project hosts a series of four high-grade uranium deposits: Paul Bay, Ken Pen, Ōrora, and the Sakura showing. The project is located just nine kilometers northeast of Cameco’s McArthur River Uranium Mine in the prolific eastern portion of Saskatchewan’s Athabasca Basin uranium district. UEC holds a 65.55% direct interest in the project and an additional 17.23% indirect interest through its 50% ownership in joint venture partner JCU (Canada) Exploration Ltd.

Project Highlights:

- The combined inferred resource across the deposits totals 20.35 million pounds U₃O₈ at a grade of 1.57% U3O8, with 16.84 million pounds U3O8 attributable to UEC.

- All deposits remain open at depth and along strike.

- Mineralization is associated with the P2 Fault structure—the same structure that hosts the McArthur River deposit.

The Paul Bay and Ken Deposits were originally discovered by PNC Exploration (Canada) Co. Ltd. (“PNC”), in 1989 and 1993 respectively. The Project was dormant from 1997 though to 2016 when it was optioned from JCU by UEX Corp. (“UEX”). UEX went on to discover the Ōrora Zone in 2017. The Sakura Zone was discovered in the summer of 2022, following shortly after the acquisition of UEX by UEC.

Since 1988, over 96,000 meters in 200 drill holes have been completed. The Paul Bay zone is entirely basement-hosted, while Ken Pen, Ōrora, and Sakura straddle the unconformity. The potential for new discoveries remains high, especially along the underexplored Yalowega Trend and other conductive corridors.

Unless otherwise indicated, the scientific and technical information herein regarding the Christie Lake Project has been derived from the NI 43-101 Technical Report dated December 31, 2021, a copy of which is available under UEX Corp.'s profile at www.sedarplus.ca.

Shea Creek

- Shea Creek, a joint venture between UEC (49.1%) and Orano (50.9%), is one of the largest undeveloped uranium resources in the Athabasca Basin, located 18 km south of the past-producing Cluff Lake mine.

- The project hosts four significant unconformity-related deposits (Kianna, Anne, Colette, and 58B)

- Strong expansion potential remains both within the known 3 km deposit area and along the largely unexplored 30+ km Saskatoon Lake Conductor Trend.

Unless otherwise indicated, the scientific and technical information herein regarding the Shea Creek Project has been derived from the S-K 1300 Technical Report Summary dated October 31, 2022, a copy of which is available under UEC's profile at www.sec.gov.

S-K 1300 Technical Summary Report - January 2023

Horseshoe-Raven

- UEC’s 100%-owned Horseshoe & Raven deposits are an exploration-stage uranium project located 5 km from Cameco’s Rabbit Lake Mill, with direct access to infrastructure.

- The shallow, basement-hosted mineralization (100–450 m depth) and absence of sandstone cover make the deposits suitable for low-cost open pit and underground mining without the need for ground freezing.

- Metallurgical testing confirmed the potential for heap leach extraction, offering a cost-effective alternative to toll milling and warranting further investigation.

Unless otherwise indicated, the scientific and technical information herein regarding the Horseshoe-Raven Project has been derived from the S-K 1300 Technical Report Summary dated December 30, 2022, a copy of which is available under UEC's profile at www.sec.gov.

SK-1300 Technical Report Summary - October 31, 2022

Hidden Bay

- UEC’s 100%-owned Hidden Bay Project is a highly prospective, exploration-stage uranium property located between Cameco’s Rabbit Lake and Orano’s McClean Lake operations, with minimal sandstone cover (0–100 m).

- The project spans over 200 km of exploration corridors, many of which host uranium mineralization and remain open for further discovery, especially of basement-hosted deposits.

- UEC has identified more than a dozen shallow-depth targets with strong potential for new basement-hosted uranium discoveries.

Diabase

- UEC’s 100% owned Diabase Project is an early-stage exploration property located on the southern rim of the Athabasca Basin, ~75 km west of Cameco’s Key Lake mill

- Exploration is focused on the northeast-trending Cable Bay Shear Zone, a major structural feature interpreted as a suture zone with potential for uranium mineralization; 67 historical drill holes have identified anomalous uranium values.

- Further exploration targets basement-hosted uranium along this underexplored structural corridor.

West Bear

- UEC’s 100%-owned West Bear Project, located in Saskatchewan’s eastern Athabasca Basin, hosts two deposits: the high-grade, shallow, open-pit-amenable West Bear Cobalt-Nickel Deposit and the classic unconformity-style West Bear Uranium Deposit (WBU).

- The Co-Ni deposit, discovered between 2002–2005, lies 30–110 m below surface along 600 m of strike length.

- The WBU Deposit is a Cigar Lake-style uranium body defined over a 530 m strike and occurs at shallow depths (15–35 m), with significant exploration potential remaining in untested basement rocks.

Beatty River Project

- The Beatty River Project is a joint venture between Orano, JCU, and UEC, located ~40 km south of the Shea Creek Deposits in the western Athabasca Basin.

- Positioned along trend of the JR Zone, Fission 3.0’s recent Patterson Lake North discovery, the project holds strong exploration potential in a highly prospective uranium corridor.

Black Lake Project

- The Black Lake Project, located 15 km south of Stony Rapids on the northern edge of the Athabasca Basin, has intersected unconformity-style uranium mineralization in several drill holes.

- The Black Lake Project is a joint venture between UEC, ALX, and Orano as partners; past exploration by UEX identified radon, radiometric, and helium anomalies supporting further exploration potential.

Carswell Lake Project

- UEC’s 100%-owned Carswell Project is located within the Carswell Structure (a meteorite impact site), the project hosts multiple uranium showings and features similar geological controls to those at the past-producing Cluff Lake Mine.

Henday Lake Project

- UEC operates the Henday Project, located less than 5 km north of Roughrider in the uranium-rich Wollaston-Mudjatik transition zone.

- The project hosts multiple high-priority exploration targets, including uranium mineralization up to 1,750 ppm in altered basement rocks that remain largely untested by follow-up drilling.

Key West Project

- UEC’s 100% owned Key West Project consists of four claims, lies directly west of Cameco’s Key Lake operation.

- The UEC team views this area as highly prospective for uranium, nickel, and cobalt, this is supported by historical exploration results.

Milliken Project

- UEC’s 100%-owned Milliken Project is located along strike of the Wolf Lake trend on the Hidden Bay Project.

- Milliken is an early-stage exploration project with geology similar to the Collins Bay/Rabbit Lake Fault system that is host to the Eagle Point mine and the now mined out Rabbit Lake pit and Collins Bay A, B, and D zones.

Riou Lake Project

- UEC holds a 100% interest in the Riou Lake Project.

- Interest in Riou Lake arose after historic radioactive boulders with up to 11.3% uranium were found in the project area.

- UEC sees potential for unconformity-style uranium deposits. Historical drilling recorded in provincial assessment filings has intersected 0.448% U₃O₈ over 0.5 m near the unconformity in hole RLG-D10.

- Historical intersection described in mineral assessment report #74O01-0030 for the Riou Lake project, accessible through Saskatchewan Energy and Resources’ Saskatchewan Mineral Assessment Database.

Other Western Athabasca Projects

In addition to the Shea Creek Project joint venture with Orano, UEC is also joint ventured in the following Western Athabasca projects in the same area: Alexandra, Brander Lake, Erica, Laurie, Mirror River, Nikita, and Uchrich. Orano is the operator of these joint ventures.

| Uranium Oxide Mineral Resources | ||||||||||||||

| Country | State/Province | Project | Measured | Indicated | Inferred | |||||||||

| Tons ('000's) |

Tonnes ('000's) |

Grade (%U3O8) |

Pounds U3O8 ('000's) |

Tons ('000's) |

Tonnes ('000's) |

Grade (%U3O8) |

Pounds U3O8 ('000's) |

Tons ('000's) |

Tonnes ('000's) |

Grade (%U3O8) |

Pounds U3O8 ('000's) |

|||

| Canada | Saskatchewan | Christie Lake | 537 | 488 | 1.57% | 16,836 | ||||||||

| Roughrider | 771 | 699 | 1.81% | 27,860 | 683 | 620 | 2.44% | 33,380 | ||||||

| Horseshoe- Raven | 11,412 | 10,353 | 0.16% | 37,426 | ||||||||||

| Shea Creek | 1,113 | 1,009 | 1.49% | 33,175 | 679 | 616 | 1.02% | 13,775 | ||||||

| Millennium | 239 | 217 | 2.39% | 11,423 | 68 | 62 | 3.19% | 4,364 | ||||||

| Canada Total | 13,534 | 12,278 | 0.41% | 109,885 | 1,967 | 1,785 | 1.74% | 68,356 | ||||||

Notes:

- The Mineral Resource estimates in this table meet S-K 1300 definitions.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- The point of reference for mineral resources is in-situ at the project.

- Mineral Resources are estimated using a long-term uranium price of $40 per pound for ISR projects and $65 per pound for conventional projects, except for the Canadian projects where a price of $56 per pound was used for the Roughrider Project, a price of $75 per pound was used for the Horseshoe-Raven Project, a price of $50 per pound was used for the Shea Creek Project, a price of $50 per pound was used for the Christie Lake Project and a price of $62 per pound was used for the Millennium Project.

- Mineral Resources are 100% attributable to the Company. Where JV projects have resources that are attributable to other companies, these resources are not listed in the table.

- Numbers may not add due to rounding.

JCU Canada Ltd. (“JCU”) is jointly owned by Uranium Energy Corp. (“UEC”) and Denison Mines Corp. (“Denison”), with UEC acting as the managing partner. Current partner equities are 50% / 50%.

Wheeler River Project (Saskatchewan)

- Largest undeveloped uranium project in the eastern Athabasca Basin.

- Joint venture: Denison (90%) and JCU (10%)

Phoenix Deposit:

- Discovered in 2008

- High-grade mineralization at the unconformity contact, to be mined using In-Situ Recovery (ISR)—a low-cost method as a new application to high-grade Athabasca uranium deposits.

- ISR mining avoids the need for a conventional mill.

- EIS is under federal technical review with public hearings to be held in late 2025.

Gryphon Deposit:

- Discovered in 2014

- High-grade, basement-hosted mineralization proposed as a conventional underground mine.

- Peak output of 9 million pounds U₃O₈/year with production over 9 years.

- Will follow Phoenix in terms of timing and will require a provincial permit and a CNSC licence ahead of project construction and operation.

Total resources:

- Phoenix Deposit –29.4M lbs. U3O8 as Measured at a grade of 21.8% U3O8, 39.7M pounds U3O8 as Indicated at a grade of 8.3% U3O8, and 0.3M lbs. U3O8 as Inferred at a grade of 2.6% U3O8 on a 100% basis. UEC attributable pounds: 3.46M lbs. U₃O₈ as Measured and Indicated and 0.01M lbs. in the Inferred category.

- Gryphon Deposit – 61.9M lbs. U3O8 as Indicated at a grade of 1.7% U3O8 and 1.9M lbs. U3O8 as Inferred at a grade of 1.2% U3O8 on a 100% basis. UEC attributable pounds: 3.1M lbs. U₃O₈ as Indicated and 0.1M lbs. in the Inferred category.

Note: Unless otherwise indicated, the scientific and technical information herein regarding Wheeler River has been derived from Denison's Annual Information Form for the year ended March 28, 2025, a copy of which is available under its profile on SEDAR+, and Denison’s other public disclosures.

Millennium Project (Saskatchewan)

- Joint venture: Operated by Cameco (69.9%), JCU (30.1%) (15.05% UEC through JCU)

- Located ~30 km north of Cameco’s Key Lake uranium mill and ~13 km west of Denison’s Wheeler River Project.

- A project description for Millennium was submitted to the Saskatchewan Ministry of Environment and the CNSC in 2009, along with a draft Environmental Impact Statement (EIS) in 2012. In May 2014, Cameco notified the CNSC that it did not wish to proceed with the CNSC’s licensing process due to economic conditions. The CNSC’s Environmental Assessment and licensing process remains on hold and can be reopened at Cameco’s request.

- The deposit is hosted in faulted basement rocks, with minimal deleterious elements.

- High-grade mineralization concentrated at fault intersections proposed to be mined by conventional underground methods.

Total resources:

- 75.9M lbs. U3O8 Indicated at a grade of 2.39% U3O8 and 29.0M lbs. U3O8 Inferred at a grade of 3.19% U3O8 on a 100% basis.

- UEC attributable: 11.42M lbs. U3O8 Indicated and 4.36M lbs. U3O8 Inferred.

Note: Unless otherwise indicated, the scientific and technical information herein regarding the Millennium project has been derived from Cameco's Annual Information Form for the year ended December 31, 2024, a copy of which is available under its profile on SEDAR+, and Cameco’s other public disclosures.

Kiggavik Project (Nunavut)

- Located 80 km west of Baker Lake

- Joint venture: Operated by Orano (66.19%), JCU (33.81%) (16.91% UEC through JCU)

- Five deposits proposed to be mined using a combination of open pit and underground mining.

- Originally submitted for federal environmental assessment in 2010. The Minister of Indigenous and Northern Affairs announced that the project was not to proceed in its current submitted form in July of 2016, due to a lack of clarity in the projects start date or development schedule.

- Stated Indicated resources of 48,953 tonnes U metal at a grade of 0.47% U and Inferred resources of 2,059 tonnes U metal at a grade of 0.38% U.

- Mineralization is in altered basement rocks—mono-metallic, low in contaminants.

- Strong exploration upside with 19 additional targets.

Note: Unless otherwise indicated, the scientific and technical information herein regarding the Kiggavik project has been derived from Orano's Annual Activity Report for the year ended December 31, 2024, a copy of which is available on Orano’s website, and Orano’s other public disclosures.

Other Projects

Close Lake

- 38,960 ha, UEC indirect ownership: 5.1564%.

- Located ~16 km from Cigar Lake.

- Two high-grade exploration drill intersections in basement rocks (1.54% U3O8 / 23 m and 0.34 U3O8% / 107.3 m).

- Historical intersection described in mineral assessment report #74H14-0065 for the Close Lake project, accessible through Saskatchewan Energy and Resources’ Saskatchewan Mineral Assessment Database.

Candle Lake

- Early exploration-stage project is 2,595 ha

- UEC indirect ownership: 15.03%.

- Uranium intersected across multiple fences, up to 0.31% U₃O₈.

- Historical intersection described in mineral assessment report #MAW00607 for the Candle Lake project, accessible through Saskatchewan Energy and Resources’ Saskatchewan Mineral Assessment Database.

Cree Extension

- Early exploration-stage project is 12,187 ha adjacent to the Millennium project

- UEC indirect ownership: 13.9683%.

- Project hosts 21 km of sparsely drilled and highly prospective geologic trends.

Moon Lake

- Early exploration-stage project is 3,798 ha

- UEC indirect ownership: 10.0747%.

- Best result: 1.09% U₃O₈ over 14.2 m near boundary with Millennium.

- Historical intersection described in mineral assessment report #MAW00094 for the Moon Lake project, accessible through Saskatchewan Energy and Resources’ Saskatchewan Mineral Assessment Database.

Wolly

- Exploration-stage project is 23,700 ha that surrounds the McClean Lake mine and mill complex operated by Orano,

- Near the past-producing Jeb and Sue deposits

- UEC indirect ownership: 6.3822%.

- Seven key exploration corridors with strong geochemical indicators.

Moore Tomblin

- Early exploration-stage project is 1,315 ha

- UEC indirect ownership: 13.5947%.

- Covers 8 km between known uranium zones; early drilling shows promise.

Waterfound

- Early exploration-stage project is 11,670 ha

- On trend with La Rocque and Hurricane deposits.

- UEC indirect ownership: 12.9%.

- Host to the Alligator and Crocodile showings with best mineralization to date grading 4.75% eU3O8 over 13.3 metres in Drill hole WF-74A.

- Denison Mines’ news release titled, “Denison Announces Intersection of Additional High-Grade Mineralization at Waterfound” dated September 13, 2022, and available under the company’s profile on SEDAR+.

Canada Careers

| Position | Location | Description |

|---|---|---|

| District Geologist Posting Saskatchewan | Saskatchewan | |

| Junior Geologist Posting Saskatchewan | Saskatchewan |

To apply for any of the above positions, send your resume and qualifications to: [email protected].